The September 2021 cover of British Vogue is turning a few heads.

Remarkably, it features the time the photograph was shot: 4.57am. The image shows actor and activist Gemma Chan leaning back on a boat in a sparkly gold dress as the sun rises, symbolic of a new dawn in fashion.

According to Vogue, Elle, and Harper’s Bazaar, now’s the time for ‘revenge dressing’ after months of standing still. Our data captures this mindset, with an increasing number of fashion-conscious consumers looking to make dramatic reentrances in post-lockdown social settings.

But going out aside, we’re also clinging to the comfort we’ve grown accustomed to in the workplace.

So depending on the product categories they sell, fashion brands will need to address these coexisting and seemingly paradoxical moods as consumers seek out cosy day-to-day transition pieces, alongside flashy evening wear.

Consumers gravitate toward products that boost their comfort.

Before we consider potential long-term changes in the world of fashion, it’s worth glancing at how our behaviors have changed over the past year.

The term ‘comfiness’ will be familiar to anyone following post-lockdown fashion trends.

When consumers first began working from home, many broke up with tight-fitted blazers and pencil skirts, swapping them for sweatpants.

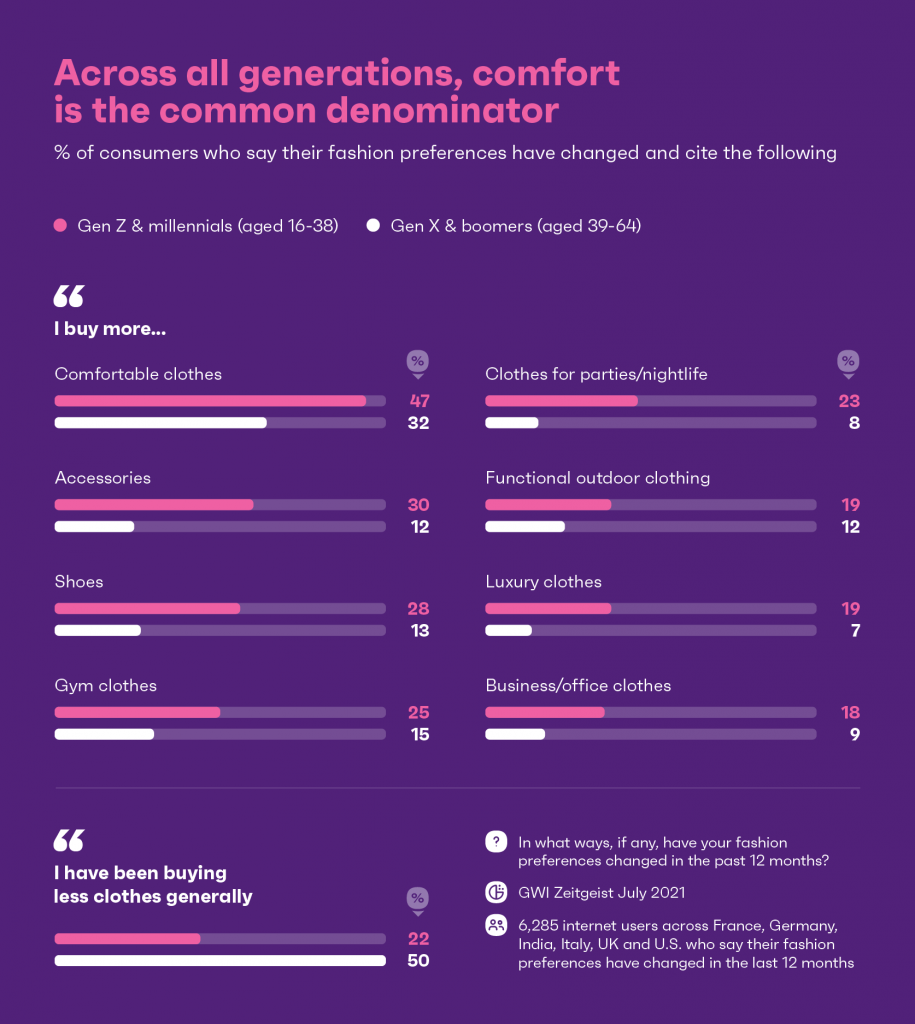

Unsurprisingly then, buying more comfortable clothes is the most common change to people’s fashion habits over the last year.

Younger consumers are typically more fashion-conscious and influenced by what’s trendy, so we’d expect their personal style to be more affected during the pandemic. And this has definitely been the case.

Overall, two-thirds of Gen X and boomers either say their fashion habits haven’t shifted over the past year, or admit to buying fewer clothes generally. In contrast, this number’s pretty much reversed among Gen Z and millennials, with 67% acknowledging a change to their everyday wardrobe.

So when speaking about the pandemic’s impact on personal style, we’ve generally seen greater casualization among younger consumers and less engagement with fashion at the older end of the age spectrum.

That being said, younger groups aren’t necessarily on the same page when it comes to clothing ideals either, which Gen Z attacks on millennial staples like skinny jeans have demonstrated.

Compared to the average, Gen Zs stand out for buying more shoes, party outfits, and accessories.

They’re also the top generation when it comes to buying more comfortable clothing, which reflects their pre-pandemic appreciation for athleisure and gender-fluid outfits.

On the other hand, millennials are most distinct for buying business and luxury clothing. Armed with the knowledge that a lot of fresh demand for office wear comes from millennials, brands in this category can cater to their particular desire for designer clothing that also promises comfort and durability.

Brands like Lee recognize that few white-collar workers are ready to give up the coziness of their pajamas, and have created bottoms that look like trousers but feel like joggers.

With more leaning toward soft breathable fabrics, companies should follow in Lee’s footprints and promote these sought-after structural qualities.

Beyond comfort, brands need to tick several boxes going forward.

This research highlights the behaviors that have translated into temporary, and potentially long-term, fashion preferences.

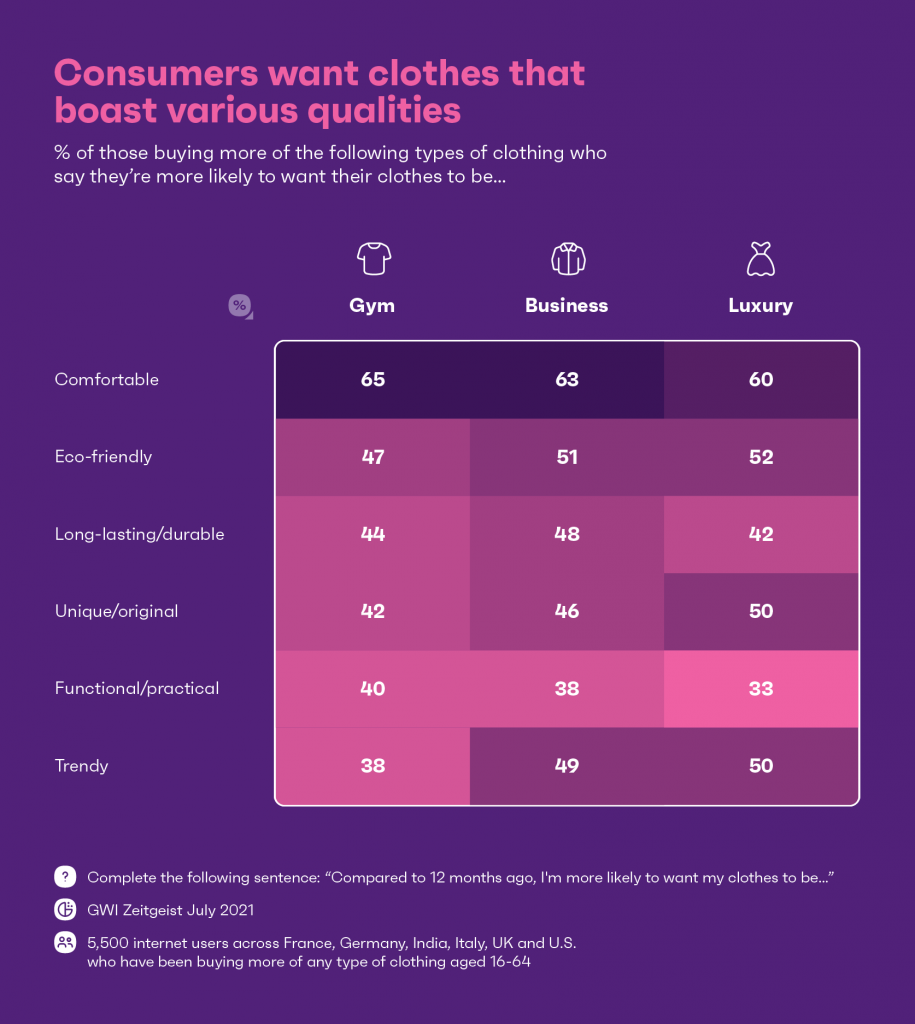

Going a step further, it also allows us to categorize consumers by the type of clothing they’ve been buying more of to see which groups have developed the most appetite for certain qualities.

Usually, price is a top purchase driver when it comes to buying clothes. While this remains the case across our various datasets, the majority of consumers aren’t looking for cheap garments despite the pandemic’s impact on personal finances.

Business and gym clothes buyers want their purchases to be long-lasting and functional, not thrifty.

Alongside luxury buyers, these consumers have a below-average tendency to spend time looking for the best deals and are considerably more loyal to brands they like. Companies selling these product types can therefore rely more heavily on strong branding than discounting prices.

The demand for unique, bold clothing is especially noticeable in the luxury category, and buyers also demonstrate the most enthusiasm for eco-friendliness and second-hand pieces.

Many fashion retailers are starting to offer these items to boost their eco credentials, with Urban Outfitters recently launching a new second-hand platform. Yet, the trend is slow-emerging, and most would rather buy from sustainable brands than purchase pre-owned clothing.

Overall, comfort and eco-friendliness are tick boxes for many consumers. On top of this, they still want their outfits to be trendy and unique, which hints at a second post-lockdown mood emerging alongside our desire for clothing that taps into the self-care and wellness movement.

‘Going out’ outfits are an antidote to 18 months of loungewear.

There’s a historical precedent for sporting extravagant looks in the aftermath of a crisis. During the Second World War, U.S. fashion was characterized by simplicity and comfort. This soon changed.

Embodying the mood of the so-called ‘Roaring 20s’, Dior released a post-war collection that promoted showy garments, which was soon referred to as the ‘New Look’ – and we can see echoes of this in the present day.

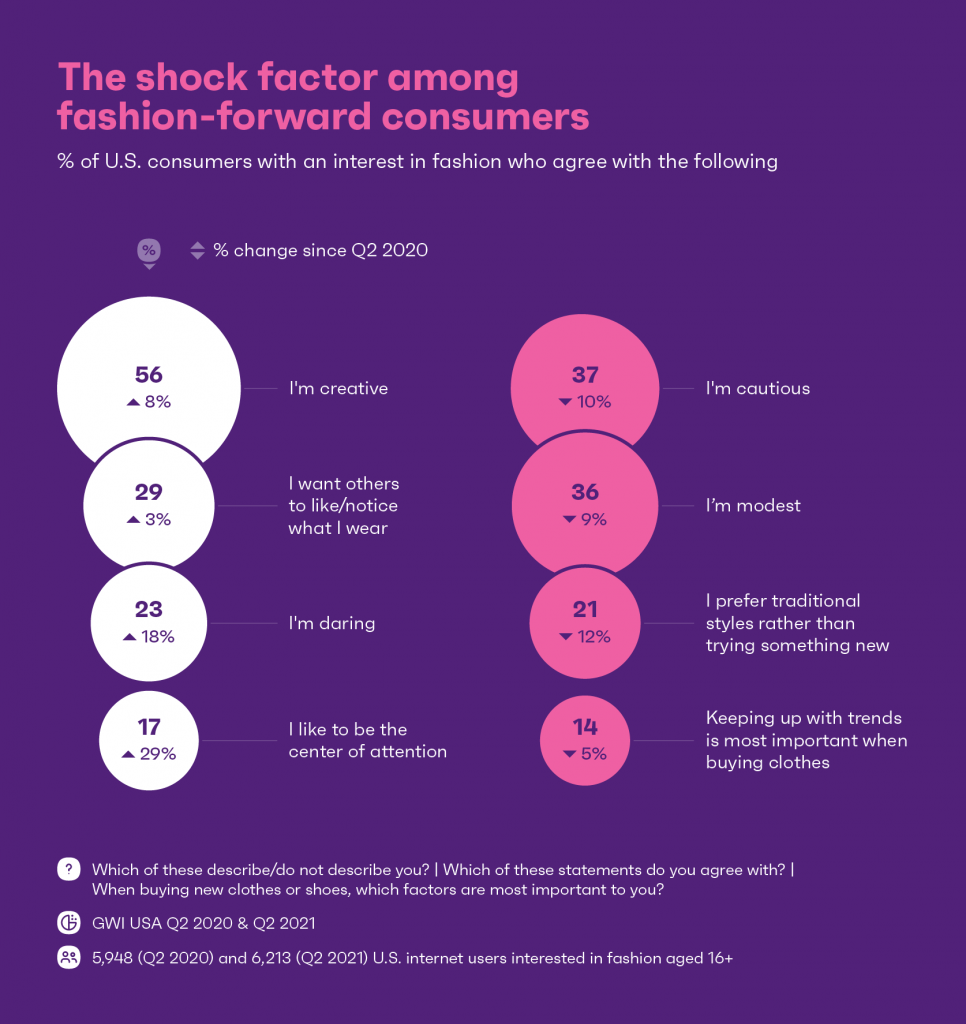

After wearing sweatpants and pajamas for an extended period of time, there’s been a noticeable shift in the attitudes of America’s fashion-conscious consumers, with many getting ready to ditch dull hues and show off.

British retailer Freemans is already feeling the early effects of this trend, with demand for stand-out outfits up over 100% on last year.

A sense of hedonism and adventure is ultimately implied by the data.

Compared to this time last year, fewer consumers identify as modest or cautious, with more aspiring to be creative and daring.

This attitude is now starting to feed into clothing choices. Today, just 14% of Gen Zs with an interest in fashion prefer traditional styles over trying something new, and there’s greater desire among all ages to be seen.

In fact, over half of fashion-conscious consumers say they either like or love standing out, rising to 64% among those who describe themself as outgoing.

There’s also been a decline in the number browsing end-of-season sales and prioritizing trends when picking out clothes to buy – which suggests a move toward expressing individuality and away from buying pieces simply to fit in.

Appetite for one-of-a-kind pieces appears to be growing, with model Lily Yeung recently launching a hand-crocheted knitwear line; and upcycling is an additional way to add flair.

RealReal’s latest collection, for example, gives new life to more than 50 pieces from big-names like Balenciaga and Stella McCartney. For each one, the designers’ original work has been expanded on to make it more dynamic and unique.

Getting ready for the roaring 2020’s

However they go about doing it, industry players will benefit from including offerings that emphasize originality, and shrouding these items in stories packed with drama and excitement.

Nothing’s set in stone, with many of us still ruminating over our post-lockdown aesthetic. But it’s unlikely we’ll be living in joggers forever.

While comfort is still high on the agenda, fashion-conscious consumers look ready to get glammed up like never before – just in time for this year’s September glossies, which all appear to be heralding ‘Roaring 20s’-style excess in fashion for the next few years.