With gaming activities migrating online, a whole host of behaviors can now be considered gaming, even if it doesn’t involve picking up a controller and playing.

The very idea of “gaming entertainment” has evolved and expanded – from entering gaming tournaments and competitions yourself, to sitting and watching others play your favorite games.

Live streaming video platform Twitch, owned by Amazon, has emerged as one of the first of its kind to capitalize on the surge in gaming and gaming entertainment being hosted online.

The live streaming video platform, which appeals to a broad range of demographics, primarily broadcasts live-stream gameplay, in addition to music broadcasts, esports broadcasts, creative content, and most recently, “in real life” streams.

Watching Twitch rise to the top has been impressive, to say the least.

Back in October 2013, the website had 45 million unique viewers, and by February 2014 it was considered the fourth largest source of peak internet traffic in the U.S., accounting for 40% of all live-streaming online according to Business Insider.

And traffic continues to grow; this year in 2019, Twitch experienced its second biggest quarter to date, capturing more than 70% of all live hours watched compared to its rivals, who made up the remaining 30%.

Competition is increasing, however, with Discord, Valve, Douyu, HUYA and Mixer doing what they can to stake their claim.

Microsoft’s Mixer is arguably one of the most pressing rivals to Twitch, especially after one of Twitch’s biggest stars Tyler “Ninja” Blevins (who had a fanbase of 14 million followers) decided to jump ship. Despite this, Twitch still remains the dominant force in terms of user traffic and sponsorship opportunities for streamers, and Ninja’s high profile move is only a testament to Twitch’s success in this respect.

In an increasingly crowded and contested space, there’s a need for brands to understand their users in greater depth. In this blog, we outline the quintessential Twitch user: who they are, what they want from brands, and what they buy.

The Twitch demographic

The rise of spectator gaming has been quick to make an impact in this space.

Whether it’s watching a live gaming stream, an esports tournament or broadcasting a live stream of your own gameplay, all three activities have increased consistently over the last few years.

3 in 10 global internet users aged 16-64 now say they’ve watched a live gaming stream recently, rising to 42% of 16-24s.

Among our youngest cohort, 32% have also watched a esports tournament and 15% recently broadcast a live stream of their own gameplay.

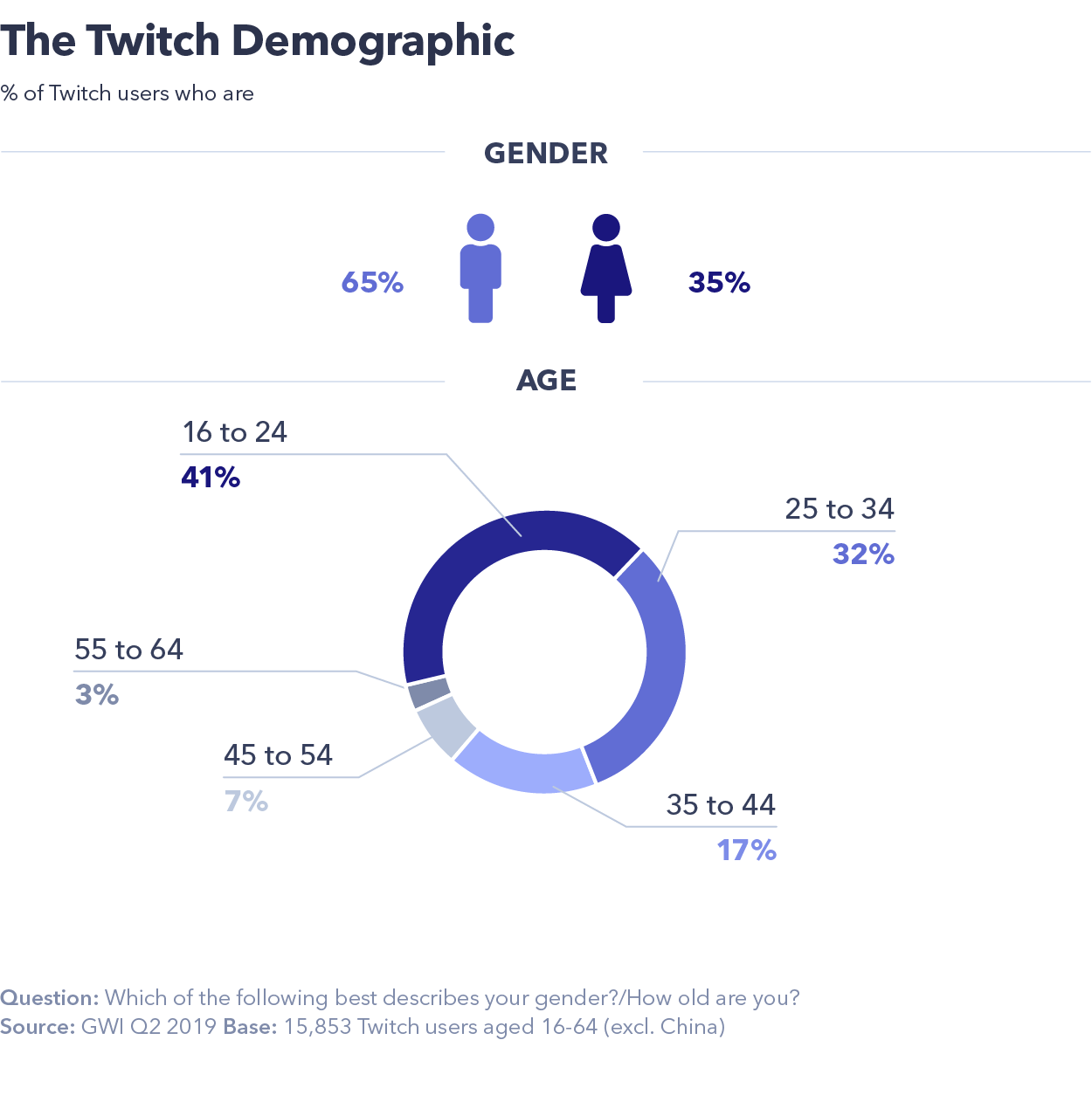

Despite female gaming becoming more prevalent, the gender breakdown for Twitch engagement is still pretty one-sided; two-thirds of this audience are male. The vast majority are between 16-34 (72%), and they over-index for being in the top 10% of income.

This gender gap is prominent throughout all five regions, shrinking to 58% of males in Latin America, where Twitch engagement is actually highest (18%).

On a local level, India has one of the highest engagements with Twitch. Esports is booming throughout India, aided by the proliferation of fast broadband connections and an outstanding number of under 25s (no country has more young people).

The importance of interrelationships

Twitch is a community-driven platform, and live streams serve as the meeting ground for many communities. Twitch streams in particular have been found to act as virtual hangouts in which informal communities emerge, socialize and participate.

Unlike YouTube, Twitch has focused a lot of its attention on its community, developing social features that YouTube doesn’t have.

The ‘clipping’ feature, for example, allows audiences to create short clips that appear on the author’s channel to show who they are and what to expect on their channel. These clips are widely used by people to boost their profile and get discovered.

And it’s this sense of community and belonging that’s reflected back in Twitch users’ online behavior:

- 58% of Twitch users have posted a review of a product, company or service in the past month, or posted a comment in a forum, in the last month, 1.4 times the global average.

- 45% of Twitch users say they would buy a product or service simply for the experience of being part of the community built around it, 1.45 times the global average.

- The most distinctive role that they think brands should play in the consumer’s life is to connect them with other fans of the brand, 1.5 times the global average.

This desire for connection, and a community which fosters it, also has important consequences on Twitch users’ unique attitudinal profile – while they are more likely to agree with typically status-seeking traits, they are less likely to be image conscious.

Also important to note is the huge overlap that Twitch shares with another community-driven platform – Reddit.

Twitch users are over 4 times more likely than the average internet user to have visited the discussion website in the last month (62% have), and 4.6 times more likely to have engaged on the site.

Buying behavior

Twitch shares 50% of its revenue with creators. And if you’re a creator that gains traction on the platform, you can further increase that percentage to 70%.

Twitch represents an important example of a major service looking for new opportunities to monetize its enthusiastic streaming community.

Most notably, it has sought to utilize its influential creator community to drive electronic game sales, by allowing creators to use their channels to promote games and receive rewards when sales are made.

Twitch’s ad model allows the top 17,000 streamers, which includes professional esports players, to participate in an ad-revenue-sharing program. But importantly, the players, not Twitch, decide in real time when they want the ads to run during their streaming sessions.

Given 3 in 10 Twitch users have purchased a game add-on or downloadable content recently (Index 2.07), and they over-index for video-based product research channels such as vlogs (21%, Index 1.71) and video sites (32%, Index 1.60), this appears to be a very sensible and profitable ad-model.

Deloitte estimates that by 2020, 60% of the gaming industry’s revenue will come from advertising.

The industry is becoming one of the most premium channels for advertisers due to the massive opportunity for ad exposure and engagement from esports tournaments and ever-evolving streaming culture.

Showcasing the potential in this space, in-game ad platform Anzu.io has raised $6.5 million in funding.

With its hyper-targeting capabilities, Anzu.io creates personalized advertising experiences within games, empowering top-tier game developers to partner with Fortune 500 brands to directly reach the audience in-game.

Both creator-led and in-game advertising have caught the eye of some of the biggest advertising spenders, including Arby’s, Audi, Gillette, Bud Light, PepsiCo and Coca-Cola.

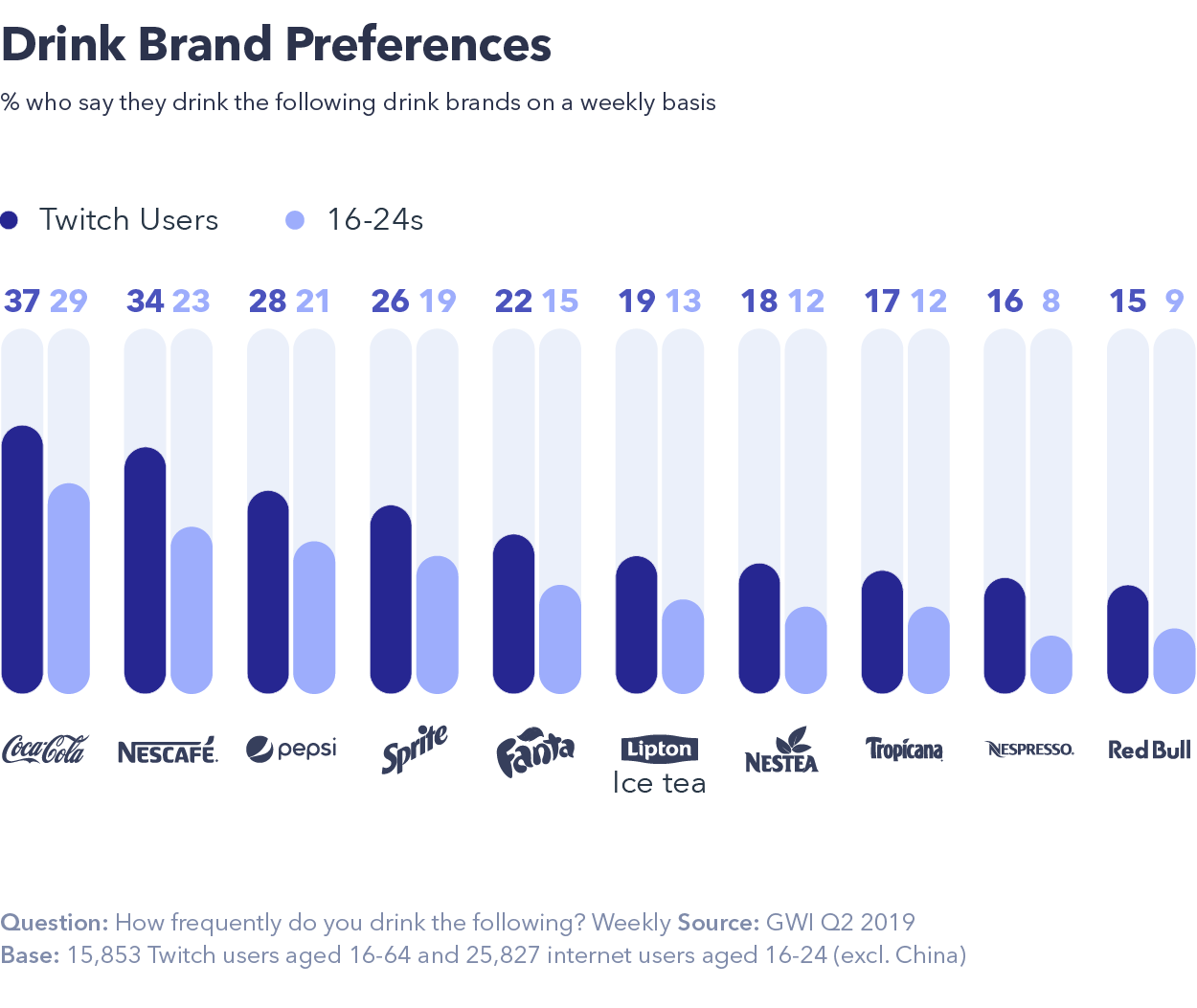

Food and snack brands have an especially promising space in live-streaming advertising. As shown below, Twitch users are much more likely to say they drink all the brands we survey on a weekly basis.

More brands are centering their advertising around esports with the hope of reaching the sports demographic sweet spot: males between the ages of 21 to 35 who are increasingly hard to reach via traditional advertising.

For marketers able to navigate the budding esports landscape, the paybacks can be huge, because gamers have shown loyalty to brands that do it right; 7 in 10 Twitch users agree once they find a brand they like they tend to stick with it.

Despite being a hard-to-reach audience, these users are highly engaged and brand-loyal, making them a goldmine for brands and advertisers.

But diversity in the gaming sector distinguishes it from other sectors.

Marketers can’t just target ‘gamers’ anymore. The fragmentation of the gaming landscape has paved the way for a certain level of tribalism among users, with each group having distinct interests, sub-cultures and rituals based on the games they love.

As such, it’s more important than ever for marketers to understand their target audience using attitudinal analytics, to make sure they’re targeting the right people with the right message.