Luxury athleisure is the fastest growing category in fashion right now as the modern consumer continues to blend comfort and style.

People’s lifestyles are becoming more casual, and their buying habits reflect that. Their new-found love affair with all things lycra hasn’t gone unnoticed by the wider industry, and many brands, be it luxury or mid-market, are keeping a keen eye on opportunities in the activewear space.

But how did athleisure clothing come to be the new daily staple for consumers? What do they expect from brands, and where are they finding their inspiration from? Let’s take a dive into all things activewear, and how brands can capitalize on the athleisure boom.

Getting ahead with the athleisure audience

With all the athleisure hype in lockdown you’d be forgiven for thinking 2020 was the break-out year for the athleisure market, but it’s actually been around since the late 70’s. Since then, athleisure has found itself in the eye of a perfect storm; rising wellness trends, a changing working environment, and a move to wardrobe casualization has drawn in more consumers who aren’t just avid sports fans. In fact, athleisure wearers are only 6% more likely to play sports than the average consumer, so don’t be fooled into thinking this is a defining factor for this audience.

And while young consumers are certainly shaping the athleisure landscape, they aren’t the only ones in the conversation. In 5 markets, millennials (69%) and Gen Z (68%) are most likely to be donning athleisure at least a few times each week, but Gen X and baby boomers are still both key players in the market – nearly 3 in 5 wear it weekly.

Athleisure consumers are more likely to be affluent individuals who seek out premium products and the community around them. Our data tells us that many are happy to gloss over a higher price tag if it means access to fashionable items that look good, have the quality to match, and make them feel a part of a social tribe. This is a likely reason why Lululemon has become a dominant force in the market; while their hit leggings can reach prices of $128, consumers stick around for the premium quality and community associated with the Lululemon brand.

There are parallels to the Gorp-core trend of recent years, as consumers increasingly buy into high quality outdoor clothing despite mainly using it for city commutes. But in both audiences, there is an underlying theme; people are buying into a certain way of living, and brands should be aware that athleisure consumers are after products that offer a premium lifestyle – not just a comfortable jacket.

Consumer expectations from luxury sportswear

As luxury consumers seek out premium athleisure apparel, it’s important for brands to get to grips with their audience’s expectations.

First of all, athleisure consumers are less price conscious, which means value-for-money isn’t the most important factor when purchasing luxury activewear. Instead, comfort, quality, and style take priority over product cost. But, there’s some regional nuances here, as consumers in the USA, UK, France are 75% more likely to prioritize value for money over those in China and Japan. So brands need to be more price sensitive when it comes to the West.

On the other hand, athleisure consumers in the East are 54% more likely to prioritize performance-enhancing features when purchasing luxury sportswear, so it can’t be all bark and no bite in regards to design and functionality. To really appeal to luxury audiences in the East, athletic wear will need to be both fashionable and reliable, with functional additions that can work in active, or more casual environments.

Brands speaking to millennials should know they are 23% more likely than average to buy luxury sportswear because of current trends. Higher purchasing power and an eye for what’s hot means millennials are often fast to jump on products that are making waves in the fashion scene. Jacquemus’ collaboration with Nike was one example of an athleisure collection that hit the mark with fashion-savvy customers. And while its price point matched Jacquemus’ usual luxury position, it still managed to sell out – fast.

Gen Z stands out in different ways when it comes to deciding on luxury sportswear; athleisure wearers in this generation are 33% more likely than average to be swayed by customization options. This is a hallmark trait of Gen Z. Since we began tracking it, they have always been more likely than other generations to describe themselves as adventurous, creative, and wanting to stand out from the crowd – customization satisfies these urges.

Brands like Nike and Adidas have both built customization into their product offering through ‘Nike by You’ and personalization initiatives. Gen Z are also thinking long term, being 22% more likely to invest in luxury sportswear if they see it has investment or resale potential later down the line. A search on Depop or Vinted can confirm this sentiment in real time, with 100’s of athleisure products listed, as consumers look to cash in on their long-lasting premium products.

How they’re keeping pace with athleisure trends

A big part of successful communication with the luxury athleisure audience means getting to know where they’re finding inspiration, and information.

For luxury athleisure consumers, fashion magazines and editorials are still a key source of style inspiration, as nearly 1 in 4 flick through the pages for the latest looks. Traditional print media does still land with the younger audiences, but if you want to land in front of Gen Z and millennial consumers successfully, you’ll need to get online.

But fashion influencers and bloggers take center stage for them, as 28% look to online opinion leaders for updates on athleisure trends. Back in August we saw fitness/wellbeing influencers in the top 3 most followed types of people online, and that’s still the case, as fitness fans are 70% more likely than average to follow influencers or other experts online. These individuals are well positioned to communicate luxury athleisure to a wider audience.

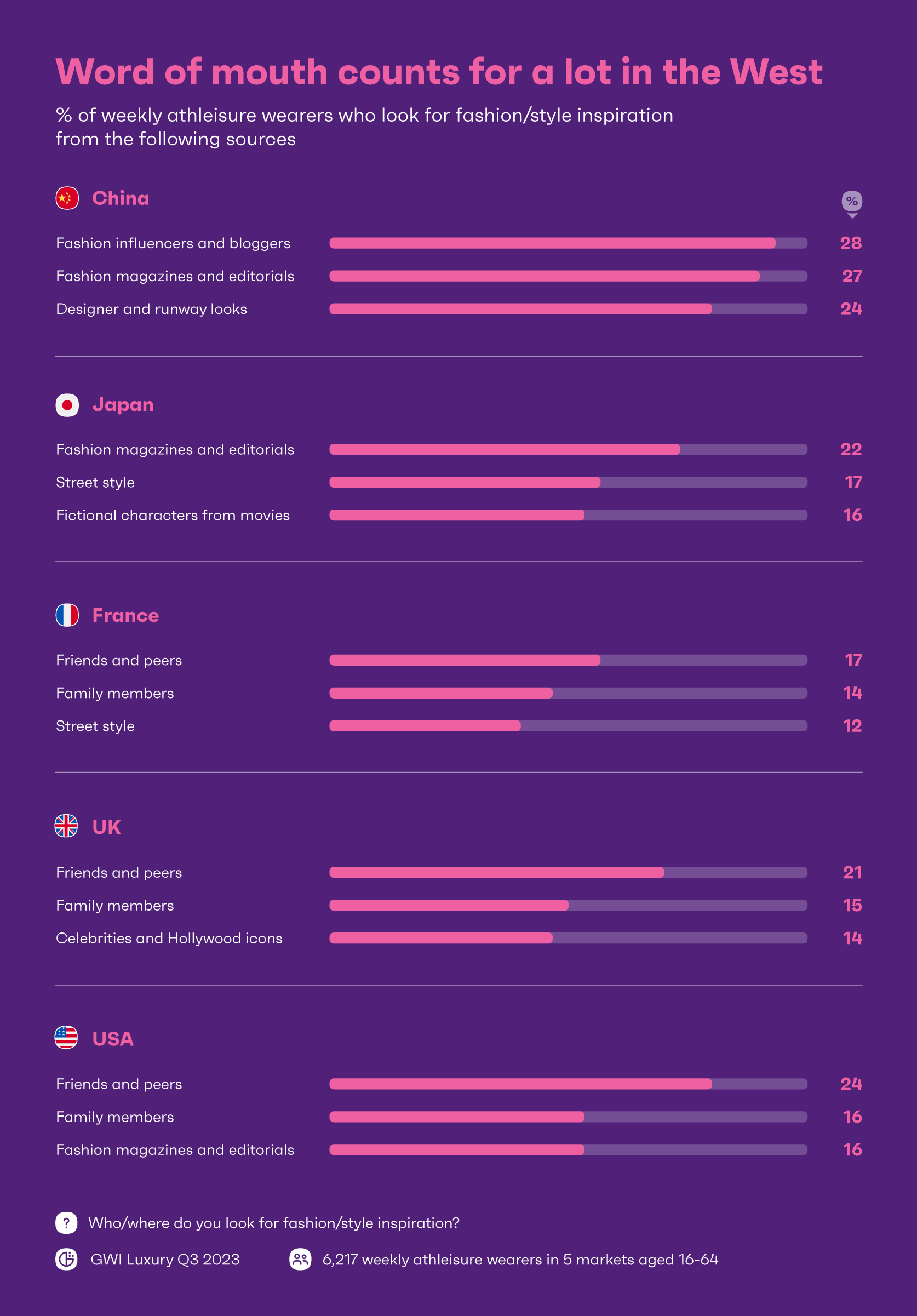

Regional nuances appear in how consumers search for inspiration when it comes to athleisure wear. Eastern markets like China are quick to look for online voices, often in the form of key opinion leaders (KOL’s).

As we touched on in this year’s social report, the multi-functional role of Xiaohongshu, or ‘Little Red Book’, plays a critical part in the discovery journey in China. Xiaohongshu is the most used platform for weekly athleisure wearers to follow trends (61%), acting as a hub for fashion inspiration and fitness motivation. Some Western brands have cemented their presence in China using the social platform, while domestic brands like Maia Active have also utilized it to gain traction with athleisure consumers in the region.

On the flip side, Western markets stand out as they look for inspiration much closer to home. Friends, family and peers play a highly influential role for luxury athleisure consumers, so brands should consider making steps to drum up word-of-mouth here. Putting on events for the brand community and getting the conversation flowing in the wider sub-cultures is a surefast way to inspire the athleisure world. On Running, Alo Yoga, and Arc’teryx all put on a calendar of mini-events that bring like-minded people together, increasing chatter around the brands.

Capitalizing on the athleisure boom through collaborations

Luxury brands often rely on their exclusive allure and aspirational appeal to speak to consumers, while sportswear brands have the upper hand in developing strong cult followings, building global communities that propel the business forward.

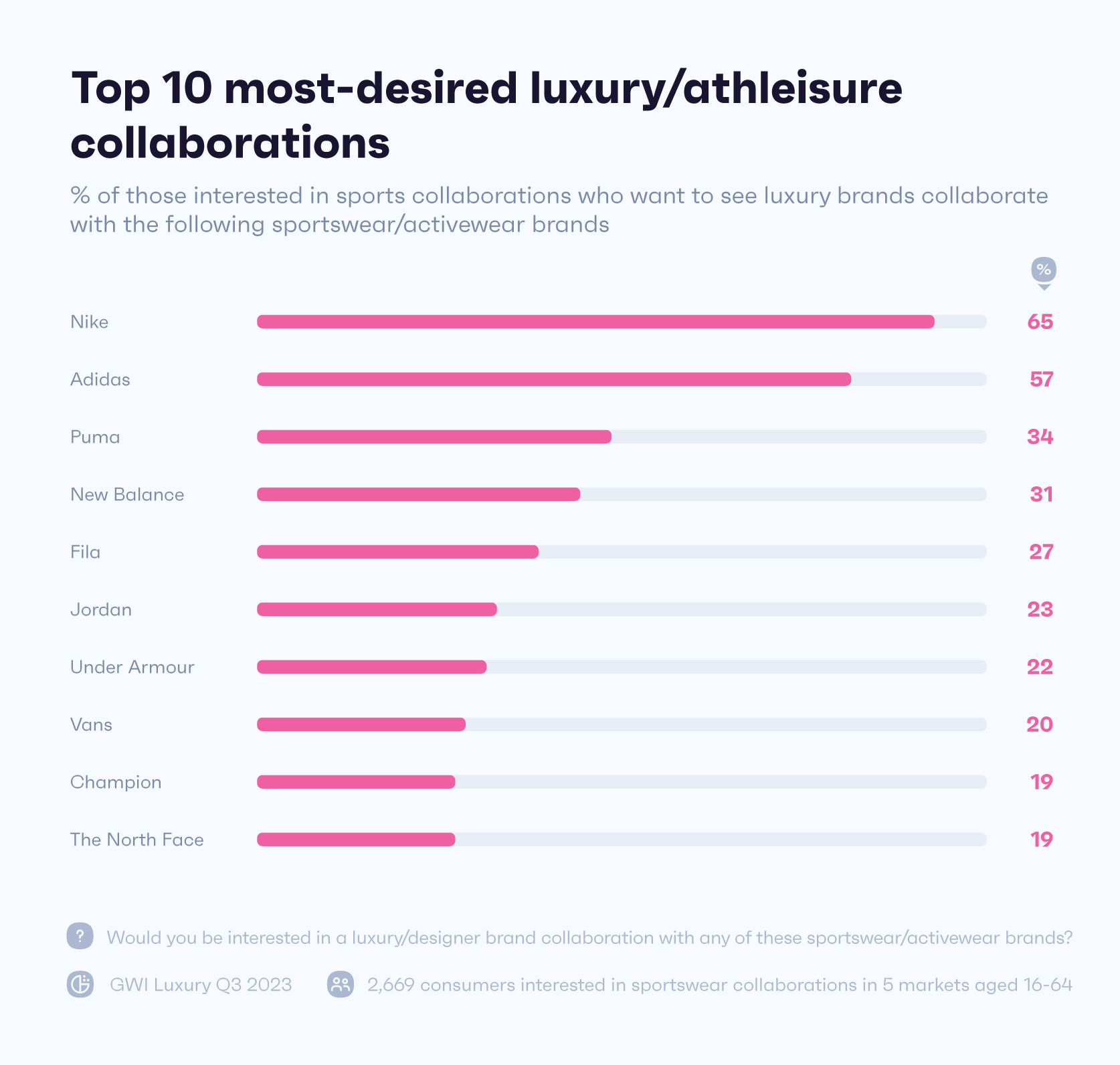

Some of the best, and most successful instances of luxury athletic apparel has come through luxury’s rebellion away from traditional products, and merging with the ‘cool factor’ of sportswear. Nike and Adidas are stand out stars, drawing in collaborations with luxury stars like Gucci, Martine Rose, and Stella McCartney – all of which have been a driving force in blurring the line between luxury and sportswear. Luxury has also looked further afield from the main stars; Moncler tapped into Hoka’s technical footwear boom, while Loewe linked with On Running. So what’s causing all of these collabs, and why are they a good move considering current athleisure trends?

First off, they’re meeting consumer demand. When it comes to any luxury collaborations, luxury buyers want designers to work with sportswear/activewear brands most (37%). What’s more, consumers expect brands to be reliable and innovative, and collaborative efforts that merge the technical prowess of sports brands with the creative flair of luxury design, satisfy these expectations. Thirdly, collaborative efforts between brands are like the holy grail to Gen Z. The generation is more interested than any other when it comes to fashion partnerships – so experimenting outside of a brand’s mainline is key to getting the attention of younger consumers. We’ve seen this play out with athleisure collaborations like Wales Bonner and Adidas, as her hit athletic tracksuits and Samba shoes flew off the shelves and racked up 1.1 million views through its TikTok hashtag.

It’s hard to replicate the authenticity, technical prowess, and trust that sportswear brands have gained in the athleisure space; luxury brands are therefore better off joining forces with them over competing in a new field. But before they dive in, there’s something important to consider. Finding partnerships that retain the integrity of both brands is essential. Nike’s collaboration with Tiffany fell flat for a lot of consumers as the match up seemed forced. So for brands looking to capitalize on rising athleisure trends, knowing which partnerships will appeal to the masses is a big piece of the puzzle.

Trends to consider before jumping the gun

Brands, both luxury and mid-market, are sure to want to get in on the athleisure action, but it’s important to approach the consumers in the right way, and know their preferences before making the first move. So here’s some key things to remember:

Athleisure isn’t just a young consumer’s game: Although some trending topics like to run away with Gen Z, for athleisure fashion, everyone’s involved. Brands would do well to consider diversifying designs, styles, and marketing that is geared towards each type of consumer.

Millennials like to follow the trends: Those aged 27-40 are far more likely to buy luxury athleisure if it fits the current styles of ‘what’s hot’. Millennials want their activewear to blend neatly into their wardrobe, giving them the options to mix and match their everyday wear with more sporty looks. As a start, brands may want to respond to colors or styles that are bouncing around this year’s runway looks.

Influencers have the edge in athleisure marketing: Physical fashion publications still land well with the athleisure audiences as many turn the pages for the latest looks, but fitness influencers are the holy grail for many. When it comes to markets like China or audiences like Gen Z, online opinion leaders are the go-to source of inspiration when it comes to athleisure outfits.

There is mutual benefit in luxury sportswear collaborations: Luxury brands may struggle to convey the same authenticity and technical performance of pure bred activewear brands, but they’re in luck. Consumers are very keen to see luxury brands collaborate with sportswear labels, so finding a strong partnership that can leverage luxury and functional knowhow is a surefire way to draw in new audiences – particularly Gen Z.