Many international beauty brands have their eyes on South East Asia. With a large and diverse population, and plenty of growth opportunities, it’s an exciting region. Representing buyers with varying needs, and priorities when it comes to beauty and personal care.

After crunching the numbers, here are the top beauty trends we’re seeing in South East Asia right now, according to detailed consumer data:

- Makeup purchases have surpassed pre-pandemic levels

- SPF is big, and it’s getting bigger

- More beauty buyers are taking care of their hair

- Health conditions are pushing people toward particular products

- Tech should be a big part of the beauty purchase journey

- It’s all about exclusive and trendy products

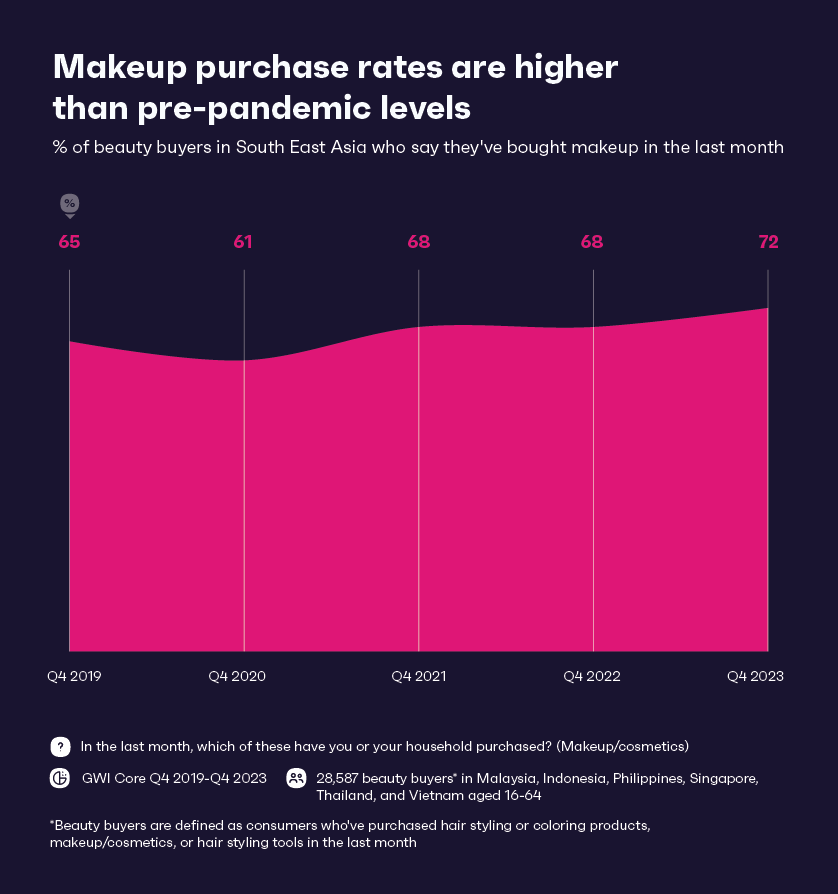

1. Makeup purchases have surpassed pre-pandemic levels

The pandemic was a strange time, and while some industries soared, others didn’t. With fewer people in the region socializing, lockdowns, and mask-wearing when consumers were finally allowed to leave their homes, it’s understandable that not many reached for makeup products.

But since 2021, cosmetics sales in South East Asia have been on the rise, with self-reported purchases in 2023 above pre-pandemic levels. The sharp rebound points to pent-up demand from lockdowns.

The “lipstick effect” also feeds into this; people in South East Asia are buying small indulgences to treat themselves during hard times, and some are wearing bold colors to help lift their moods. We’ve seen year-on-year jumps in people buying blusher, lipstick, and eyeshadow in the region.

Since 2021, there’s also been a 23% rise in the number of men in South East Asia buying makeup.

Largely thanks to more male celebrities embracing makeup and inclusive marketing, brands targeting this region have new audiences to target.

The level of growth shows how resilient the beauty industry is in South East Asia. It didn’t take long for it to catch up to pre-pandemic purchases, and the world we live in today is very different to 2019. People are clearly still interested in makeup, and brands need audience insights to keep up with opportunities and changes in the beauty market.

2. SPF is big, and it’s getting bigger

It’s not the most glamorous of beauty products, but increased awareness of the impact of the sun on both health and aging has led to growth in people reaching for SPF.

In South East Asia, 2 in 5 beauty buyers have used suncream in the last week, and almost as many have used a facial moisturizer with SPF.

In the last two years, the number of beauty buyers in South East Asia who use suncream has grown 12%.

It’s clearly become a go-to product in many people’s routines.

Gen Z and baby boomers are seeing the biggest jumps in demand. And, nearly 1 in 5 Gen Z beauty buyers in SEA use anti-aging cream/serum, proving that youthfulness is a huge commodity even among younger audiences.

UV protection is a big beauty trend in Indonesia and Thailand in particular, as beauty buyers in these countries come out top globally for using facial moisturizer with SPF and suncream.

With a growing demand for SPF products in South East Asia, brands have an opportunity to establish themselves in this expanding market and speak to specific groups. This could be through broadening their range, packaging products in innovative ways, or adding skincare benefits to formulas.

For example, Thai consumers are big on anti-aging serum – over a third of beauty buyers here use it weekly, while Indonesians use relatively more lipstick and lip liner. So brands looking to break into these markets could do well by adding anti-aging benefits to their formulas and broadening their product range to include SPF. Skincare-makeup hybrids have been building traction in the last few years, and it looks like they’re here to stay.

3. More beauty buyers are taking care of their hair

Hair and scalp care is rising in popularity among beauty buyers in South East Asia. The number who use hair oil weekly has grown 17% year-on-year, with buyers in this region standing out for purchasing specific haircare products.

Indonesia, for example, is the country in the world most likely to use anti-dandruff shampoo, while Thailand stands out for using volumizing products. Brands that harness natural ingredients to cleanse, strengthen, and revive tresses from root to tip stand to win big with this regional audience.

Beauty buyers in South East Asia aren’t just interested in taking care of their hair though, they’re also into styling it. The number who’ve used a highlighter (+33%), relaxer (+14%), and hair wax (+21%) in the last week have all risen year-on-year.

This region’s increased interest in styling and haircare may give brands the opportunity to create more multi-purpose products, which change the look of hair, while still maintaining its health. For example, hair coloring packs with nourishing ingredients.

4. Health conditions are pushing people toward particular products

The health conditions people suffer from may steer them toward targeted beauty products which promise relief. In South East Asia, sleep-related conditions stand out as the most common health issue, with beauty buyers here being 13% more likely to experience them than the average consumer in the region.

The number of beauty buyers who suffer from sleep-related conditions has grown 20% since 2020.

For brands, there’s a chance to double down on solutions which aid rest. Ingredients like lavender, chamomile, or CBD can have a relaxing effect, and therefore help prepare the body and mind for sleep. So, beauty brands should look to include some of these ingredients in their products, and focus their messaging around making these buyers feel pampered.

Beauty buyers in South East Asia are also distinct for dealing with skin-related conditions, meaning they may also be interested in products which promise to be gentle, fragrance-free, and have calming ingredients.

By catering to the unique health struggles faced by South East Asian consumers, beauty brands stand to make meaningful connections through tailored products. Companies that truly understand this market and its relationship with health are more likely to flourish in it.

5. Tech should be a big part of the beauty purchase journey

Beauty buyers in South East Asia are very interested in tech. Over half say they follow the latest technology trends and news, and the number who own a VR headset (+10%) and use TikTok effects (+6%) has grown between 2020-2023.

This means that beauty buyers in South East Asia are likely to be keen on beauty-related tech – like LED masks and electronic facial massagers.

Their interest in tech also means they’re more open to embracing AI and AR in the purchase journey. Brands could look to make customers’ purchase journey more immersive and personalized; this could be through offering AR try-ons and allowing beauty buyers to virtually sample products and shades, or by bringing AI into the purchase journey.

In Singapore, over half of beauty buyers say they’d be comfortable using an AI-integrated tool to buy a product or service.

AI could be used to handle customer queries, to provide recommendations, or even create personalized beauty subscriptions based on customer preferences. A good example is personal care company Shiseido‘s cutting-edge “smart mirror” known as the Skincare Advisor.

Whatever technology tools companies choose, many beauty buyers in South East Asia are ready to embrace it.

6. It’s all about exclusive and trendy products

If brands are going to engage with beauty buyers in South East Asia, they’re going to have to embody what these shoppers want.

First off, beauty buyers want brands to be exclusive, trendy, and young. In Singapore, they’re 28% more likely to want ads to make them laugh, and 1 in 4 forward on memes weekly. So, keeping on top of the internet culture they’re driving forward could make a big difference. It’s also key to keep beauty buyers excited by releasing limited edition and exclusive collections, for example, a quarterly collection focused on a hero ingredient.

In terms of what these consumers want brands to do, they’re most ahead for improving their online image or reputation, closely followed by running customer communities and offering customized products.

Brands could help improve their customers’ image by highlighting customer success stories, or allowing followers to submit content using their products for a chance to win a prize or be featured.

And when it comes to customized products or services, investing in consultation experiences online or in-store to gauge individual needs and personalize recommendations is a good way to go. This could be particularly appealing to any beauty buyers who suffer with skin complaints.

In a nutshell, the beauty scene is just as big and flexible as ever. The trends we’ve outlined are shaping how we see and snag our favorite products, and beauty brands should be familiar with them if they want to keep their glow.