Disney+ hopes to serve up 50 new APAC originals by 2023, producing plenty of local language content. Why? Because it’s an attractive region for streaming services looking to scale up their subscriber base.

Netflix surprised investors when its total audience fell for the first time in over a decade. But it had one trick up its sleeve: APAC, where it added 1 million subscribers between April and June 2022.

Inspired by the giant’s success, various streaming services are spending big as they attempt to win over the region’s viewers.

With this in mind, it’s useful to understand how online TV has evolved in this part of the world, as well as the opportunities that have sprung up in the last year.

Online TV has overtaken broadcast

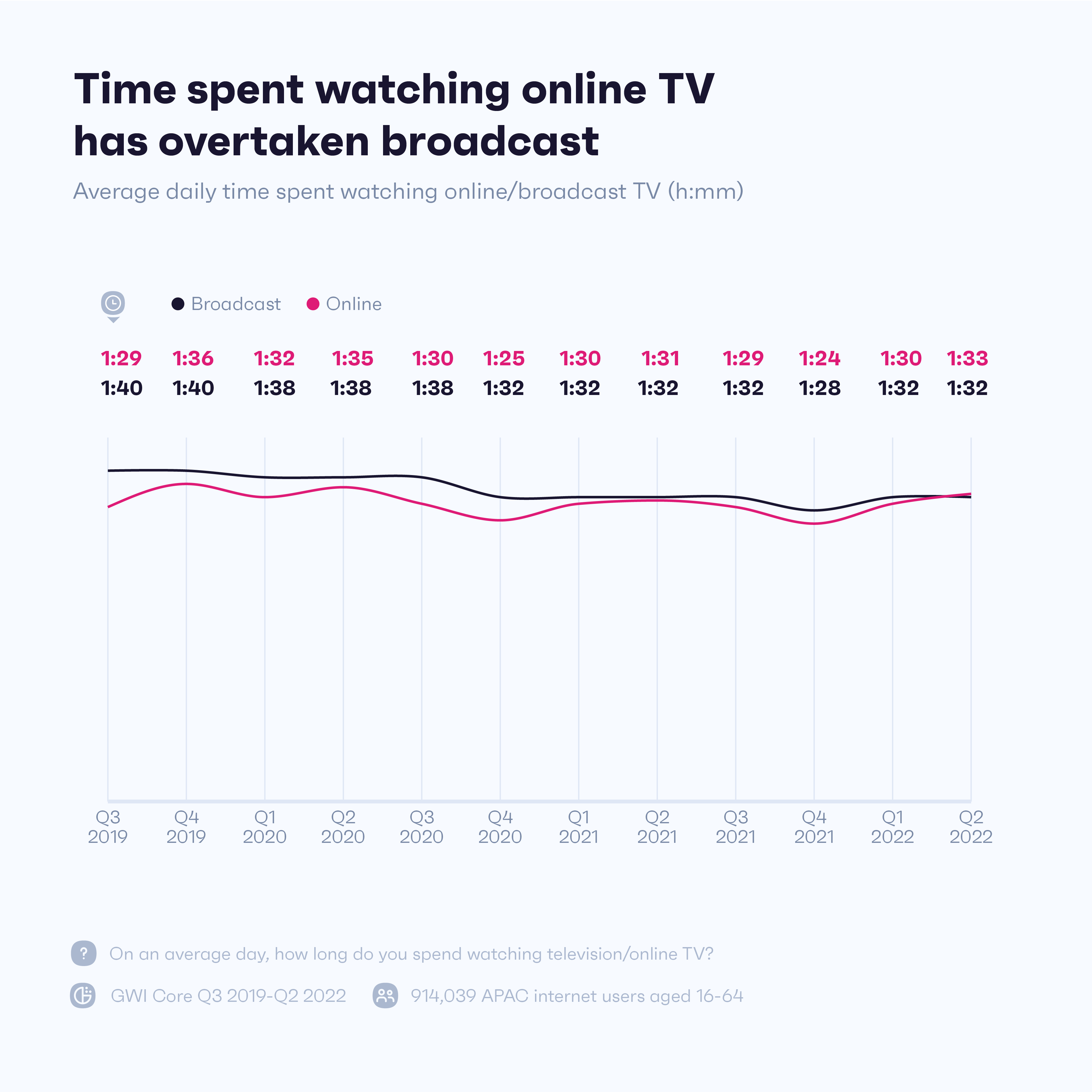

When time spent watching online TV peaked during lockdowns, the main questions on our minds were: is this a one-off for the industry? And will we see these highs in a post-pandemic world?

Compared to 12 months ago, we’re in a very different situation. The worst of the virus has passed and some kind of normality has returned. Yet, as the Covid situation improved, a cost of living crisis took its place, driving many consumers to rethink purchases like in-home entertainment.

Around a quarter of streamers in five APAC markets are thinking about canceling a TV subscription, with the main reasons being ‘paying for too many services already’ or ‘wanting to use another one instead’.

It seems consumers have a limit to the number of platforms they’re willing to pay for, and that limit may get smaller as inflation continues to bite, especially in parts of the region where price sensitivity is higher.

But this just means they’re open to breaking up with services, not the industry – which is thriving right now.

In fact, the time people spend watching online streaming has overtaken traditional TV for the very first time in our latest wave of data. It may be by a slim margin, but it’s a huge win for the sector.

Also, the number of people who say they use a TV streaming service on a typical day has stayed fairly consistent since Q1 2020.

The years between 2016-19 represent the biggest jumps in online TV usage, and progress is unlikely to ever happen that quickly again because the untapped market in many countries is smaller than it once was.

Still, our data suggests that recent joiners are sticking around, and that time spent watching online TV will continue to creep up.

This is good news for companies introducing cheaper ad-based subscription models and those hoping to advertise on streaming sites, as more time spent on them means more ads watched.

Plus, APAC’s consumers are the most likely to approve of ad-supported tiers and to say they’d exchange their personal data for free services. So, if this model’s going to land anywhere, there’s a good chance it’ll be here.

India’s a force to be reckoned with

Beyond the cost of living crisis, what’s going on in specific countries also makes APAC’s future a little harder to predict. That being said, these changes do bring new opportunities to light.

Internet users in China and India are well ahead of the wider region for online TV engagement; but they’ve switched positions since 2019, which reminds us how fast the tide can turn.

Alongside an economic downturn, the Chinese government clamped down on fan-based culture in 2021. This led to less choice across genres like reality TV, causing demand to dip.

As this happens, Chinese platforms like Tencent Video and iQiyi are pushing Chinese language content in other markets, placing extra focus on Southeast Asian countries.

Meanwhile, more smartphone availability and affordable subscription plans are boosting online TV’s success in India.

And since 2020, local platforms ZEE5 and Sony Liv have both earned a spot on our leaderboard for the region’s top 10 services, overtaking Chinese players like Sohu and Mango TV in the process.

China’s an inaccessible market anyway, and if we remove it from the equation, the rise of APAC’s online TV sector is even more impressive than our first chart suggests.

As more Indian consumers step into this space, competition will inevitably heat up, with the country set to have an increasingly bigger impact on wider streaming trends. Despite being notably tricky to break into, services have found success in India by focusing on original content across genres, targeting niche audiences, and catering to its various languages.

It’s not all about mobiles

It’s not just longer binges that are shaping the direction of online TV. The devices people use to watch them are also leaving their mark.

Around the world, more people stream content on a TV set than a phone, but in APAC, the opposite is true. Here, mobiles take the prize.

Not only that, they’ve continued to grow as a way to tune in. Outside China, the number using TV subscription services on their phones grew by 33% between 2018 and 2021, which helps explain why the region’s often described as mobile-first.

But small screens aren’t the only headline.

Across these countries and within this timeframe, there was a 54% jump in people streaming via their TV sets.

These devices definitely have their place, and they’re becoming more central to online viewing habits over time, especially as they get smarter.

Around 2 in 5 APAC consumers own a smart TV, a figure that’s risen by 25% in the last two years. Not to mention, TVs are the go-to device for streaming in half of our 14 markets, and they have a big lead on phones in Australia, New Zealand, and Vietnam.

This is good news for advertisers according to Google, as Connected TV (CTV) users are more engaged and emotionally invested. They’re more likely to watch with someone else and better audio/visual quality means the experience is more immersive.

Those who stream via TVs are also a slightly different audience to those who watch on mobile; compared to the latter, they skew older and wealthier. So, brands have a chance at connecting with a valuable part of the non-traditional TV audience.

And there’s plenty of success stories to draw on. Indian food delivery service Swiggy, for example, adopted a CTV-first strategy to win over those ordering in while streaming the Premier League. The decision clearly paid off, as it reached 47% more high-income households, raising its profile and prompting viewers to download the app.

Asian pop culture on the western stage

Here’s another reason why APAC’s so appealing to streaming businesses. The Korean dramas and Japanese anime shows taking off there are also catching on elsewhere in the world. If you want proof of this, you can find it in the incredible 14 Emmy nominations racked up by Netflix’s “Squid Game” in July.

It’s worth keeping tabs on what’s gaining ground in this part of the world, especially if successful shows or films can be repurposed later on as foreign-language media.

Even so, content costs are rising, which means providers can no longer afford to spend first and ask questions later. And, though consumers in APAC are cost-conscious, they’re value-conscious more than anything.

When paying for a service, content that’s relevant to their interests (60%) and original content (49%) are more important than price (44%).

This means that, though the region’s potential pay-off is huge, it’s challenging terrain.

While each country takes more of a shine to certain genres, here’s a general overview of the ones catching on or dropping off right now.

A lack of sports in 2020 saw it slide down the rankings and it hasn’t been able to reclaim its position just yet. The fall of cultural channels, lifestyle shows, and soap operas has been even sharper, with the cancelation of long-running Australian soap “Neighbours” touted as the end of an era for the genre.

Luckily, drama, comedy, and children’s TV were there to fill in the gaps. Whether intense or light-hearted, they allowed people to escape everyday reality when times were tough. Even reality TV offered consumers a window into a very different life, unlike lifestyle shows around gardening and cooking.

What’s more, while kids and education channels may once have been seen as a means to stop parents canceling accounts, we’re well beyond that. In Disney+’s latest round of Asian content are five animated series, an adaptation of a popular Korean webtoon, and the first series developed in partnership with Indonesia’s Bumilangit.

For companies wanting to stay culturally relevant in APAC and create compelling foreign-language series, these are important trends to watch.

A lot of growth to come from APAC

The next couple of years won’t be without their challenges, but they’ll also be a time of excitement and innovation for the industry.

New business models and partnerships, as well as fresh takes on today’s fast-moving culture, are just some of the changes we’re going to see.

And with the West mostly covered and China inaccessible, APAC’s moving closer to the heart of all this.

If you want to know more about TV streaming in APAC, you can find our insights and so much more in Avia’s 2023 Asia Video Industry Report.