For international businesses, a consistent, global understanding of what their audiences think, feel and do is essential for success. With authoritative data to call on, they can find insights that take the guesswork out of decision-making.

But international isn’t everything. Businesses with a national focus need a local solution – one that enables them to take a dive deep into domestic markets to uncover audiences and opportunities that otherwise might get overlooked.

For these businesses, local knowledge means they can:

- Be properly data-driven at every level

- Get agile and ready for scalable growth

- Become more versatile and efficient

- Get clear on what’s coming next

This is seriously important stuff, so we’ll explain each in turn.

Be properly data-driven at every level.

Not all big brands have a global presence. Those who’ve chosen to stay at the national level have just as much need for data as their more international equivalents.

These local brands can be huge businesses, dominating the local market and influencing the local population’s perceptions and attitudes – perceptions they need to understand to really get through to them.

Imagine a clean energy company entering a new national market that doesn’t have an incumbent eco-friendly supplier. This energy company fills their marketing with messages that underscore their green message. Using the right tools they could track the market penetration of their brand at the national level, using the results to fine-tune messaging based on attitudinal and behavioral insights, so they’re always on point.

The big benefit of local insight for local businesses is essentially this: replace guesswork and gut-feel with hard evidence and data-driven decisions.

Get agile and ready for scalable growth.

Successful businesses react to changes in circumstances, attitudes and behavior at top speed. One of the factors driving in-housing – the process of bringing specialist skills like research inside an organization – is the way it increases speed and convenience, with vital expertise available across the hall instead of across town.

In the case of research there’s an additional, related factor. Your researchers may be close at hand, but is your data locally relevant?

Because if your market is domestic, having your research teams on-hand won’t deliver the right agility/growth benefits unless they’ve appropriate local data to dig into. We see 3 big benefits here, all making the case for local data.

1. Speed up the research process.

By sidestepping time consuming back-and-forth with external agencies, businesses can get data-led, locally-relevant campaigns up and running in less time.

Bringing the ability to generate local insights in-house means decision makers can move at the speed of trends – local trends.

For researchers and marketers used to regular Google Analytics updates and hourly social listening bulletins, this responsive approach makes perfect sense, finally putting the consumer research cycle in sync with other data sources.

2. Minimize risk with data-led budgeting.

Strategy is a big part of improving ROI. But not just any strategy – it has to be data-driven to really deliver.

Now, “data-driven” means different things to different people, and its definition has certainly changed over time. What we mean here is that if your market is local, then your data should be too. Because insight should steer investment – that’s the key to effective budgeting.

With local facts at their fingertips, marketers can go straight to the right channels, avoiding the risk and waste of trialing different approaches based on data too general to be truly useful.

3. Own the purchase journey from start to finish.

Too often brands get second-hand knowledge of their target consumers, drawn from a mishmash of sources and analysed by a mix of methodologies. The result makes it hard to join the dots.

In contrast, having global and local consumer data available on-tap from in-house researchers is worth its weight in gold. Owning all parts of the process in this way puts control back in the hands of marketing teams. Robust, relevant, up-to-date consumer data means they’re consumer-centric from start to finish.

Become more versatile and efficient.

Global data sets inevitably focus on certain areas at the expense of others. That’s hardly surprising – no single data set could possibly cover everything. Adding locally-focussed data plugs this gap, but introduces a new issue.

Nothing impacts the flow of research like having to constantly swap between tools and data sets. It’s awkward, time-consuming and every changeover is an opportunity for error.

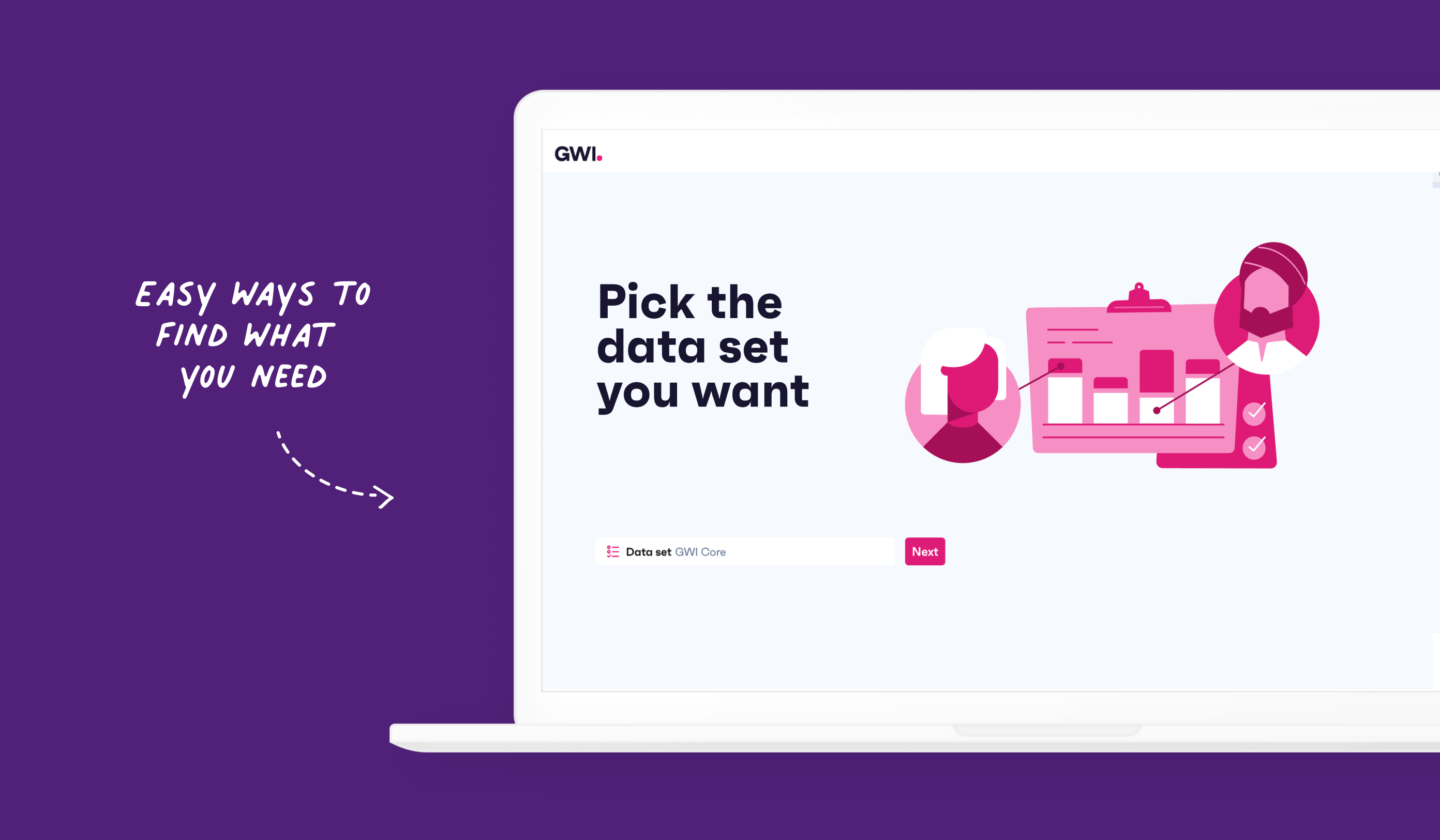

The solution is to use a single platform – like GWI – able to handle global and local data sets. If both use the same respondents over the same period, then comparing data points is easy, adding incredible versatility.

For time-poor teams, especially those struggling with reduced headcount in the post-pandemic world, having a single source of truth like this is an absolute godsend.

The ability to bring global and local together in this way sidesteps problems like not being able to co-ordinate at scale due to too many data sources, or agency partners producing conflicting insights because they’ve used different data sources. It enables researchers to benefit from the breadth of global and the depth of local.

Get clear on what’s coming next.

To explain this, let’s shift gears and bring this discussion into the real world.

We recently expanded our flagship survey, adding more in-depth data on local sectors and brands across four European markets with insights on sectors like travel and utilities. The result helps you put a local spotlight on things you couldn’t see before.

Let’s take travel for example.

No other industry has felt the impact of Covid-19 quite like travel. The industry is busy reinventing itself to provide the experiences that travelers and holiday-makers now expect. As with many other sectors, there’s a push to bring services in-house and shift to a single source of insights. To do that, they need to know what audiences think and where the market is going next, which is where our data comes in. Here’s how.

1. Understand today

Our data shows that consumers’ own countries are the most popular destinations across the four major markets of France, Germany, Spain and the UK.

Even more interesting is that these staycationers are 10% more likely than the average consumer to consider reviews when booking accommodation.

We can also dig into who likes to stay in which hotel chain. For example, hotel customers in France prefer Ibis, in Germany it’s Best Western, in the UK it’s Premier Inn, while in Spain it’s Melia.

And the benefit of all this? Simply that with this sort of local data at their fingertips, national brands can fine-tune strategy and decision-making to account for local preferences. No more trying to extrapolate from general, international trends; just focussed, local data that supports local success. Again, powerful local insights with the potential to steer marketing strategy and support success.

2. Predict tomorrow

As well as reflecting local markets today, our data paints a clear picture of what the future holds – part mirror, part crystal ball.

For example, a whopping 45% of vacationers intend to take a beach holiday in the next 12 months, and even describe what they’ll do when they get there.

In France, travelers are as likely to go sightseeing as to hit the beach (41%), while in Spain it’s the other way around (47% vs 43%). Meanwhile for Brits, city breaks are almost as popular as beach vacations (42% vs 43%).

It even reveals that those embarking on an active vacation are far more likely to consider the facilities/amenities in a hotel, while for those planning a special occasion trip, the reviews and the room quality stand out most.

The point is that smart travel operators can use information like this to segment their offer by travel intent and traveller interest.

3. Identify opportunity

Cruising is a form of holiday usually associated with older people. Contrary to expectations, our data shows that it’s younger people who’re more interested in going on cruises in the future.

This local lens reveals facts that challenge conventional wisdom and highlight opportunity.

Perhaps surprisingly, it turns out 25 to 34 year-olds are the most lucrative segment here, with a hefty 57% interested in booking a cruise in the future, a whole 11% more than 55-64s.

We can also see 16-34s interested in booking a cruise are more likely than the average consumer of the same age to be interested in adventure/extreme sports, information that savvy brands could use to build campaigns around, say, a promise of adventure.

4. Advertise effectively

When it comes to researching and booking travel, Booking.com leads the way by some distance as consumers’ top choice. A whopping 39% across these 4 markets say Booking.com is their first choice, way ahead of the second most popular option Airbnb (13%).

That said, when it comes to age, Airbnb performs better among younger audiences, with 19% of 16-24s saying they’d go there first, but it’s still 3 in 10 who prefer Booking.com.

The significance of this? Although Airbnb and Booking.com are essentially competing to take a larger piece of the same pie, they don’t necessarily target or attract the same audiences. Knowing who looks where at a local level means being able to spend wisely, and target right.

*Unless otherwise specified, all stats are from Q3 2021 of GWI Core Plus – our new extension that puts a local spotlight on 4 key markets.