Behind every great brand is a great bunch of researchers.

These people bring together tools and teams, probably from across the globe, to inform key decisions and define how the business will look tomorrow.

Take the tech sector, for example. They’re (unsurprisingly) no strangers to gathering and utilizing heaps of data, but there’s a caveat:

Can too much data from different sources be, well, unhelpful?

2020 taught us a lot, but the path ahead isn’t as clear as it might once have been.

For those tasked with blazing a trail through the thicket of uncertainty ahead, we’ll show you how to prioritize your data sources, so at least that part’s easy.

Spoiler alert: it starts and ends with working smart.

The struggle is real for researchers

To make the right decisions consistently, you need good data.

But when there’s an overwhelming amount to sift through and limited time, it’s difficult to pull out those business-changing, golden nugget insights.

Susie Hogarth, Research and Cultural Insights Director, at We Are Social puts it well:

“Research and insight has to work harder and harder to be three things all at once; useful, insightful and agile. And it’s a real challenge for researchers to get the balance right.”

Prioritizing your data is a job in itself.

Researchers and analysts share a few common grumbles, so these might sound familiar.

Handling multiple data sets, tools and teams across regions.

Forget collaboration, you want cohesion. With marketing and business strategy teams (most likely) dotted across the globe, each with their own research techniques, half the job is agreeing on the right approach.

Tracking the full consumer journey across regions and channels.

You might have some pretty slick first-party data, but that will only get you so far. To build a customer journey map that’s actually valuable, you want to look further than behaviors alone, and into what’s really driving them to take action (or not…).

Getting answers quick using slow, traditional research methods.

In today’s landscape, you’re trying to stay nimble and adjust to changes on the horizon. Instead of trying to predict the future, you want to be reactive in the present.

Lacking a global view and an understanding of local markets.

When you have markets spanning multiple countries, you need local strategies. But devising a targeted plan of action requires visibility over each and every market.

What to prioritize when it comes to data

With so many moving parts to the modern research team, success is about organization, i.e. how well you use the tools at your disposal and how well you share that knowledge with others in the team.

But when it comes down to the types of data you use as your guiding light, there are some qualities that separate the wheat from the chaff.

Accuracy. Leave no room for error: If the aim of any research team is to help your leaders make the right calls, then using inaccurate data is as useful as a chocolate teapot. You want deep data that’s been scrutinized, so you can scrutinize it some more.

Speed. Get answers when it matters: Adjusting to unexpected bumps in the road is normal, but made more simple if you’re able to be reactive and prepared.

Intuitiveness. It’s got to be simple to use: Market research and analysis isn’t ‘easy’, but the whole process can be made much more simple when the data tools you use don’t slow things down. A little bit of consistency goes a long way.

Reliability. Especially in times of crisis: During the pandemic, businesses want their sources to be bedrocks of reliability. After all, you invest in them to give you the answers you need.

Total harmonization. Link all your markets and channels: Perhaps the most important piece of the puzzle is your data’s adaptability. Harmonization means the data is all collected using the same methodology, no matter what region, country, channel or platform you’re looking at. Cross-compare at your leisure.

Think of the above as a topline checklist – but factor in the context your business sits in and how you operate. Ultimately, teams working in silos isn’t helpful in the long term, so:

Consolidate your tools and give them what they need to gather consistently accurate insights at speed.

Data harmonization in action: cross-comparing social platforms

Any company worth its salt has more first-party data than it knows what to do with. Very useful for looking back and seeing what’s worked, but not quite so useful when planning for the next chapter – especially in today’s climate.

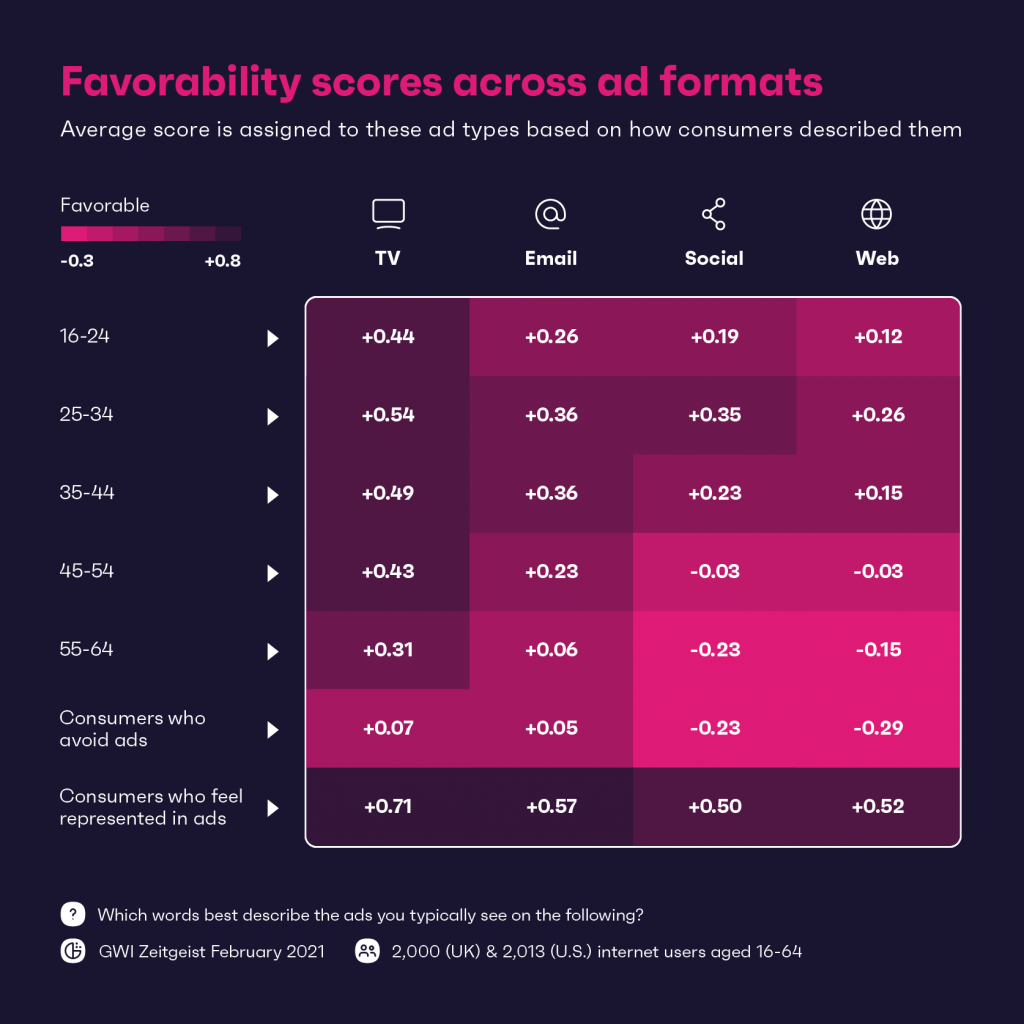

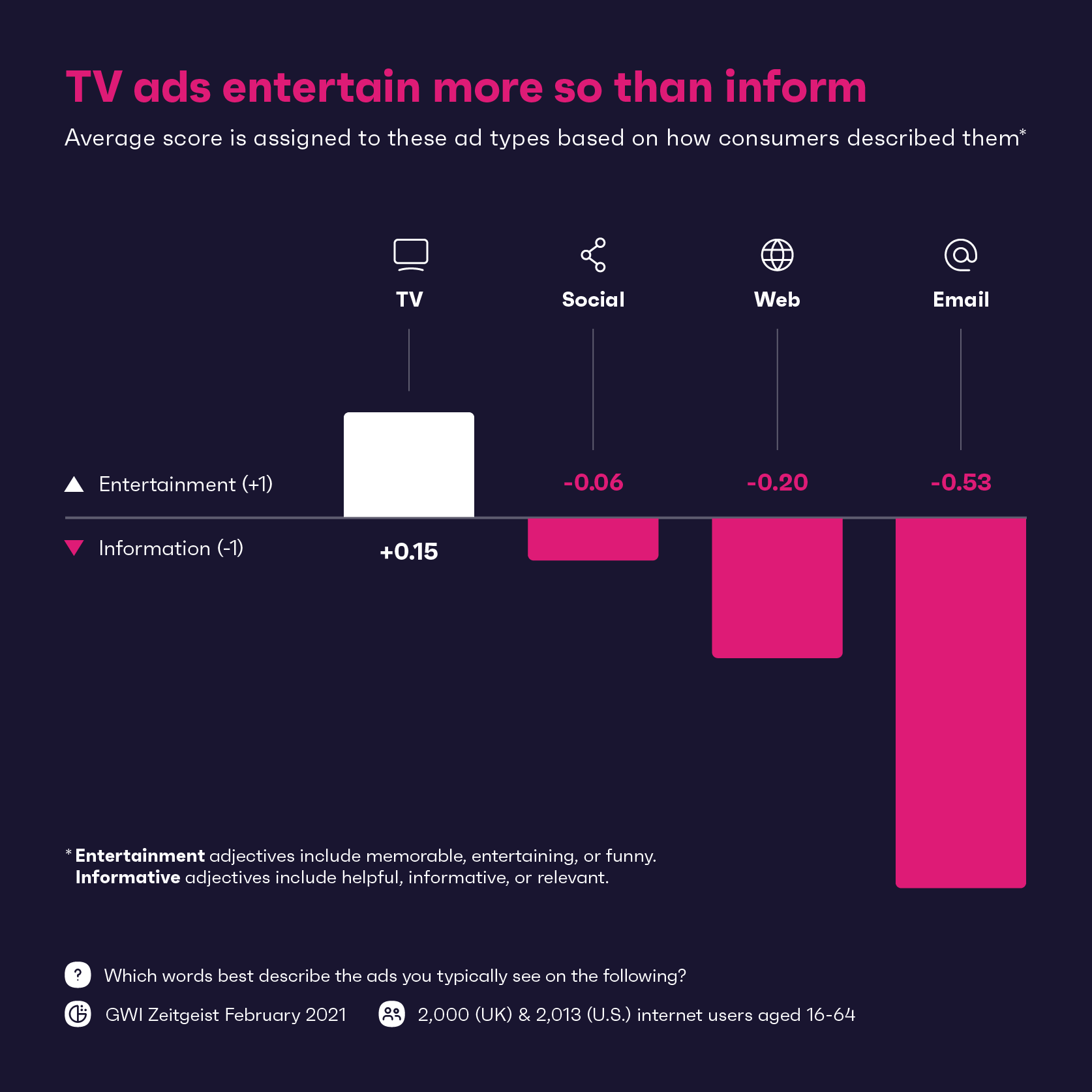

In this example, we’re zoning in on one priority above to showcase how single-source (harmonized) data lets you compare channels like-for-like. Specifically, we’re looking at brand research on social platforms.

Remember: it’s not just channels you can compare, it’s regions, markets and audiences too.

This simple chart shows popular platforms for brand research and the crossover between social networks.

For example, 60% of people who search for information about brands on Pinterest, also look on Instagram. With this in mind, being selective about the social platforms you choose to invest in could lower your media spend.

Weave insights like these into your first-party data and you’ll have a rounded idea based on what’s working for your business, but also how your market is thinking and behaving.

Who’s doing it right? Match Media Group, that’s who.

Online dating tech titans, Match Media Group, were looking for answers on how the behaviors and attitudes of singles have shifted in the pandemic.

Their priority was to put their consumers at the center of their new targeting strategy.

Using our coronavirus research (which focuses on the global consumer landscape), they built and applied their own audiences to pinpoint how these changes were affecting them.

A new trend they uncovered was the surge in video dating, or ‘dating from home’.

Research revealed 31% of their audience on one platform was up for taking part in a shared activity.

This includes things like playing a trivia game or cooking together.

“We use these insights to help our sales team go after new accounts or tell a better story as to how our consumers are behaving, thinking and buying”, says Divya Lakhati, Market Research Director at Match Media Group.

Having found out that shared activity was a top preference of today’s dater, it gave them licence to engage with relevant advertising partners for collaboration.

Knowing what their users were looking for and pitching to advertisers that work in that space helped Match Media Group best serve their audiences in uncertain times.

See the full story here.

Key takeaways

The truth is, if you work in sectors like tech, you’re always going to have to juggle data sources because you should always have first and third-party data.

But juggling two data sets is easy.

When it comes to third-party data, there’s scope for saving energy and money by putting it all under one roof. This gives you:

- More control: Be sure the data you’re using is accurate, and get better oversight over how you’re handling the data.

- More consistency: Don’t waste time using multiple data sets, putting square pegs in round holes.

- Better collaboration: Make sure all teams are aligned, using the same processes and communicating effectively.